washington state sales tax everett wa

Use this search tool to look up sales tax rates for any location in Washington. To calculate sales and use tax only.

Washington Sales Tax Guide For Businesses

For tax rates in other cities see Washington sales taxes by city and county.

. The Everett Washington sales tax is 970 consisting of 650 Washington state sales tax and 320 Everett local sales taxesThe local sales tax consists of a 320 city sales tax. This is the total of state county and city sales tax rates. There is no applicable county tax or special tax.

Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property. 2022 2021 2020 2019 2018 2017 2016 Effective 2022 Local sales use tax rates alphabetical by city. Decimal degrees between 450 and 49005 Longitude.

Use tax is paid at the time a vehicle is registered with the Department of Licensing if sales tax was not paid at the time the vehicle was acquired by the current owner. The County sales tax rate is. The minimum combined 2022 sales tax rate for Everett Washington is.

The December 2020 total local sales tax rate was also 9800. The December 2020 total local sales tax rate was 10100. Kennewick WA Sales Tax Rate.

Look up a tax rate. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle. Businesses making retail sales in Washington collect sales tax from their customer.

Washington has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 31. Combined with the state sales tax the highest sales tax rate in Washington is 106 in the cities of Lynnwood Bothell Everett Edmonds and Lynnwood and two other cities. 1 State Sales tax is 650.

The Everett Sales Tax is collected by the merchant on all qualifying sales made within Everett. The Everett Washington Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Everett Washington in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Everett Washington. It is comprised of a state component at 65 and a local component at 12 38.

Bring your questions at 10 am. A retail sale is the sale of tangible personal property. Bremerton WA Sales Tax Rate.

Kent WA Sales Tax Rate. If you can provide proof that the person who gave you the vehicle or vessel paid sales or use tax on the vehicle or vessel no use tax is due. Lacey WA Sales Tax Rate.

The statewide motor vehicle surtax or 003 has been collected since 2003 applies to all retail sales leases and transfers of motor vehicles and is used to finance. Federal Way WA Sales Tax Rate. Kirkland WA Sales Tax Rate.

Lists of local sales use tax rates and changes as well as information for lodging sales motor vehicles sales or leases and annexations. Person must pay the tax and may then take a credit equal to the state share of retail sales tax paid. Washington sales tax rates last updated May 2022.

2 Washington has state sales tax of 65 and allows local governments to collect a local option sales tax of up to 31There are a total of 106 local tax jurisdictions across the state collecting an average local tax of 2341. Average Sales Tax With Local. Washington collects standard the state sales tax rate of 65.

The Sales and Use Tax is Washingtons principal revenue source. Search by address zip plus four or use the map to find the rate for a specific location. Retail Sales and Use Tax.

Thus vehicle sales taxes in Washington can range from 73 to 103 based on where the transaction is made. The 99 sales tax rate in Everett consists of 65 Washington state sales tax and 34 Everett tax. Youll find rates for sales and use tax motor vehicle taxes and lodging tax.

There are a total of 105 local tax jurisdictions across the state collecting an average local tax of 2368. If the person who gave you the gift owned the vehicle for 7 years or more and is from a state or province with sales tax it will be assumed that tax was paid and no proof is. Sales Tax and Use Tax Rate of Zip Code 98208 is located in Everett City Snohomish County Washington State.

Total 77 103. Use our local Tax rate lookup tool to search for rates at a specific address or area in Washington. To calculate sales and use tax only.

Everett WA Sales Tax Rate The current total local sales tax rate in Everett WA is 9800. Quarter 1 2022 Jan 1. Everett WA Sales Tax Rate.

You can print a 99 sales tax table here. Retail sales tax includes both state and local components. Download the latest list of location codes and tax rates alphabetical by city.

Silverdale Washington and Everett Washington. The seller is liable to the Department of Revenue for sales tax even if it is not collected. The Everett sales tax rate is.

Use our local tax rate lookup tool to search for rates at a specific address or area in Washington. For example for a taxable gross revenue amount of. The present tax rate is 01 0001.

ZIP--ZIP code is required but the 4 is optional. 2022 Cost of Living Calculator for Taxes. The Washington sales tax rate is currently.

Penalties and interest are due if tax forms are not filed and taxes are not paid by the due date. Quarter 2 2022 April 1 - June 30. 31 rows Bellingham WA Sales Tax Rate.

Quarterly tax rates and changes. Sales tax amounts collected are considered trust funds and must be remitted to the Department of Revenue. This is multiplied by your gross receipts to compute your taxes due.

This would happen if a vehicle was purchased from a private party or if it was. Use our Tax Rate Lookup Tool to find tax rates and location codes for any location in Washington. There are a total of 105 local tax jurisdictions across.

Sign up for our notification service to get future sales use tax rate. Use tax is paid by the consumer when retail sales tax was not collected by the seller. 100000 the business pays 100.

Edmonds WA Sales Tax Rate. Vehicles received as gifts.

Washington Sales Tax Guide And Calculator 2022 Taxjar

Washington State Sales Tax Rate Usgeocoder Blog

Closing Costs In Washington State

Spring Refi Special Prestige The Prestige Wa State Puget Sound

The Snohomish County Washington Local Sales Tax Rate Is A Minimum Of 6 5

Washington Sales Tax Small Business Guide Truic

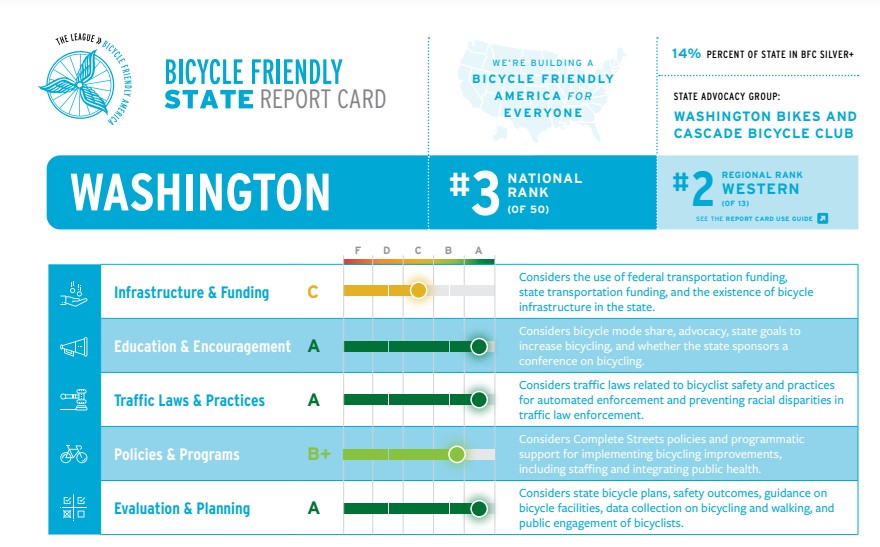

Blog News Washington Bikeswashington Bikes

Top 10 Healthiest Cities In Us Centrum New Orleans Healthy

Washington State Women S Rights And Big Cities Fivethirtyeight

Washington State Sales Tax Rate Usgeocoder Blog

Washington State Sales Tax Rate Usgeocoder Blog